The Ethos Lever Model: Impact Investing, Explained

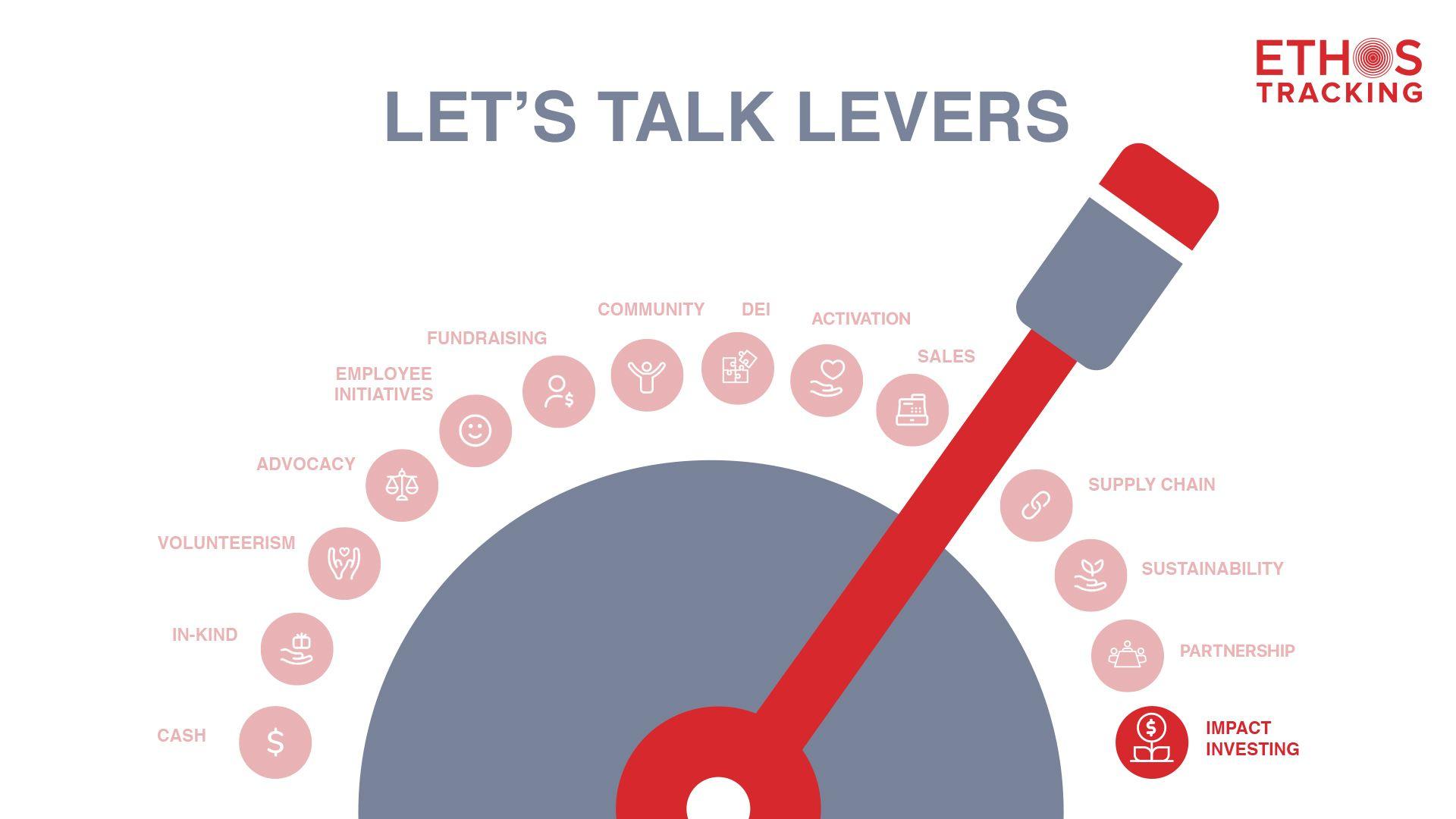

The Ethos Lever Model utilizes fourteen different “Levers” by which an organization can make an impact. Each Lever serves a real opportunity to create value - but when strategically pulled together, result in a powerful and cohesive Social Impact strategy.

In this blog series, the Ethos team breaks down each Lever - complete with expanded definitions and real-life examples - so you can best understand how to pull the right Levers through your organization's social impact work. See all 14 Levers here.

Lever: Impact Investing

The Impact Investing Lever refers to companies using the corpus of a fund or other working capital to invest in mission-aligned for-profit businesses.

Maximize Impact Investing:

- If your organization manages large portfolios, reach out to colleagues involved in that work. Discuss whether your organization’s strategy in flexing those funds could support its social impact objectives.

- As always, create (and utilize) criteria to ensure Impact Investment efforts are strategically leveraged - as a starting point, all activations should align with at least one other Lever.

Impact Investing: A Real-Life Example

Kroger – a longtime supermarket chain – has been leading a fight to eliminate food waste through its Zero Hunger/Zero Waste program, launched in 2017. The USDA estimates that of all food produced in the United States, 40% of it is wasted – thrown away to culminate in landfills, rotting and emitting harmful methane. This waste is generated throughout the entire spectrum of the food supply chain and systems, with more than 14% stemming from grocery retail. Kroger’s social impact plan sets out to end hunger in its communities and eliminate food waste across its industry.

To support other companies working to combat this problem, Kroger established The Kroger Co. Zero Hunger | Zero Waste Foundation Innovation Fund, which invests in businesses launching new consumer products made with surplus food or food byproducts and technologies to advance the upcycled food industry. “The Innovation Fund was designed to bring like-minded organizations together as philanthropic disrupters – setting a new course on how to partner and change the world.”

In early 2021, the Fund invited innovators to submit proposals for non-dilutive grant funding, ultimately selecting startups to receive a total commitment of $2.5 million in impact investment funding from the Foundation. The peer-selected startups included Agua Bonita, makers of “ready-to-drink aguas frescas from upcycled produce, served in culturally inspired and recyclable cans,” and Matriark Foods, which “upcycles farm surplus and fresh-cut produce trimmings into healthy affordable products for institutional foodservice, diverting food from landfills while feeding communities healthy food.”

Other companies which have received impact investment funding include Imperfect (an online grocer which sources imperfect produce and surplus food directly and delivers these goods to customers through a subscription service); Re-plate (which leverages the gig economy to redistribute surplus food from businesses and events directly to nonprofits in need); Food Forest (an app to source products through multiple channels, minimizing the carbon footprint of delivery logistics); and mobius (which converts industrial organic waste streams from food, forestry and agriculture into renewable chemicals and materials).

We applaud Kroger for incorporating the Impact Investing Lever in its multifaceted-impact approach to fight food waste, which will ultimately have far-reaching implications on food security and the environment.